Co-investment opportunities in High Conviction ASX Capital Raises

Why Choose Ignite Equity

Our co-invest model means that you are investing alonside professional investors and the lgnite Equity team.

ALIGN WITH THE BEST

With a strong due diligence process, we work hard to mitigate your investment risks.

STRONG DUE DILIGENCE

With a strong due diligence process, we work hard to mitigate your investment risks.

We take the hard work out of investing with a suite of Trading & Execution services.

TRADING + EXECUTION

We take the hard work out of investing with a suite of Trading & Execution services.

ALIGN WITH THE BEST

Each opportunity is corner-stoned by the directors of Ignite Equity – Shaun Factor and Greg Lowe who are leaders within the ASX capital raise sector

STRONG DUE DILIGENCE

With a strong due diligence process, we work hard to mitigate your investment risks.

TRADING + EXECUTION

We work alongside investors to maximise market returns to ensures we maintain a strong and trustworthy relationship.

INDUSTRY CONNECTIONS

Take advantage of our huge network of brokers and strong relationships built over 20+ years along with many ASX listed companies reaching out to us when raising capital.

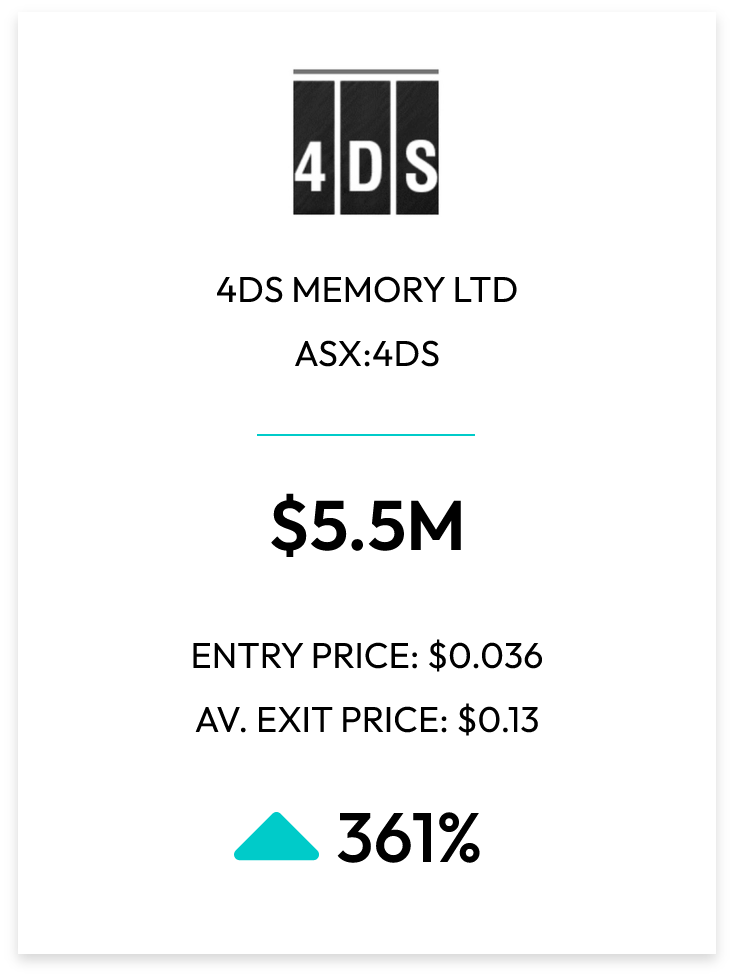

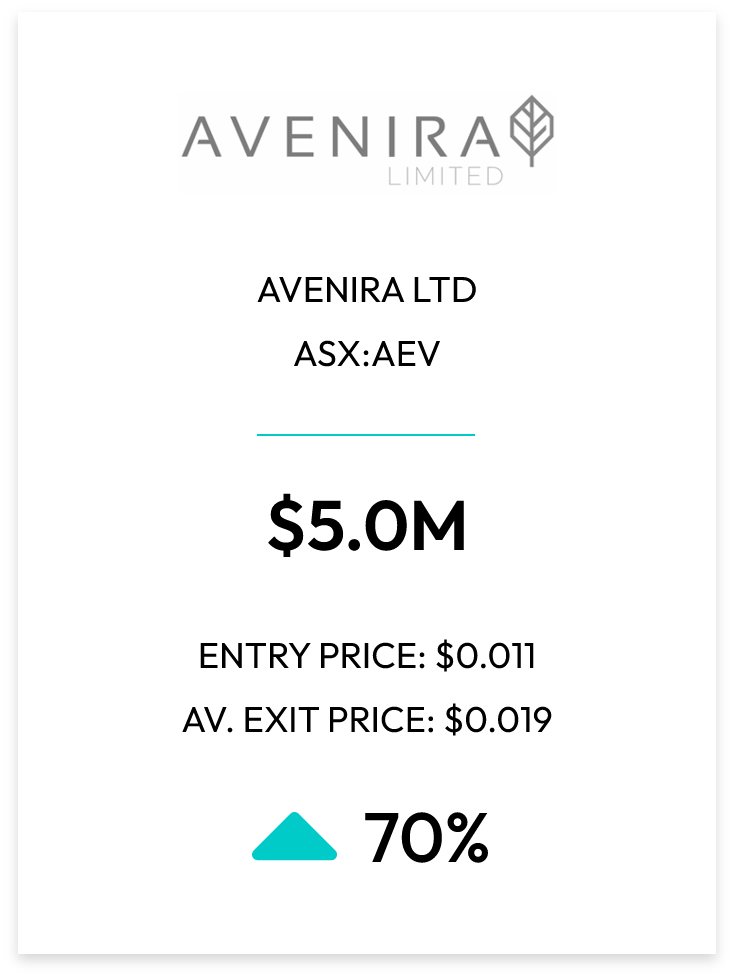

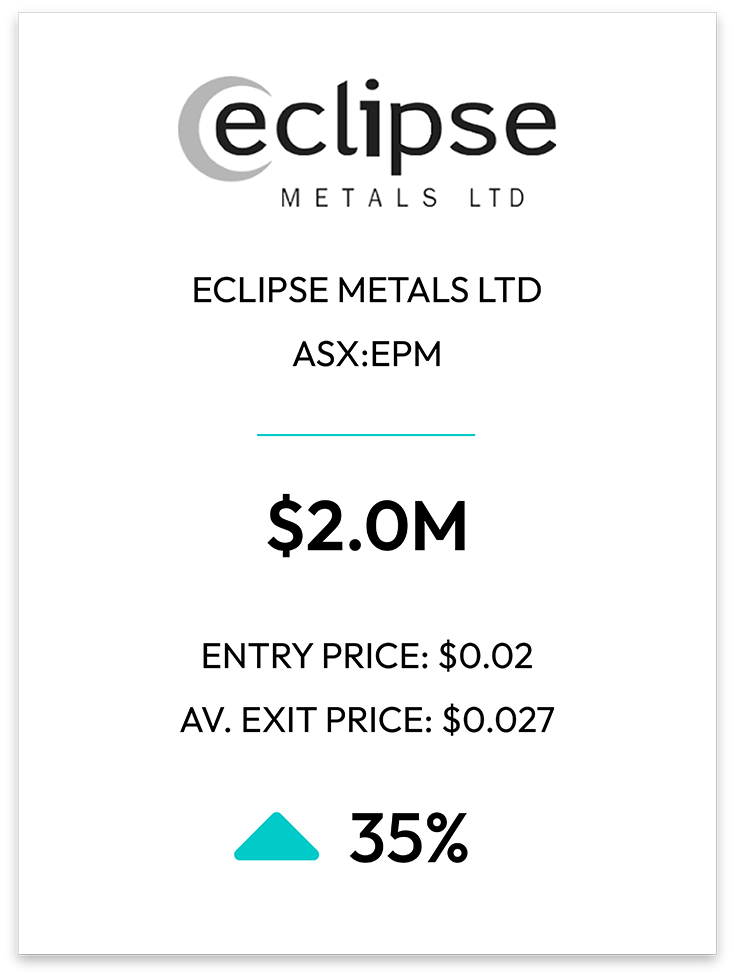

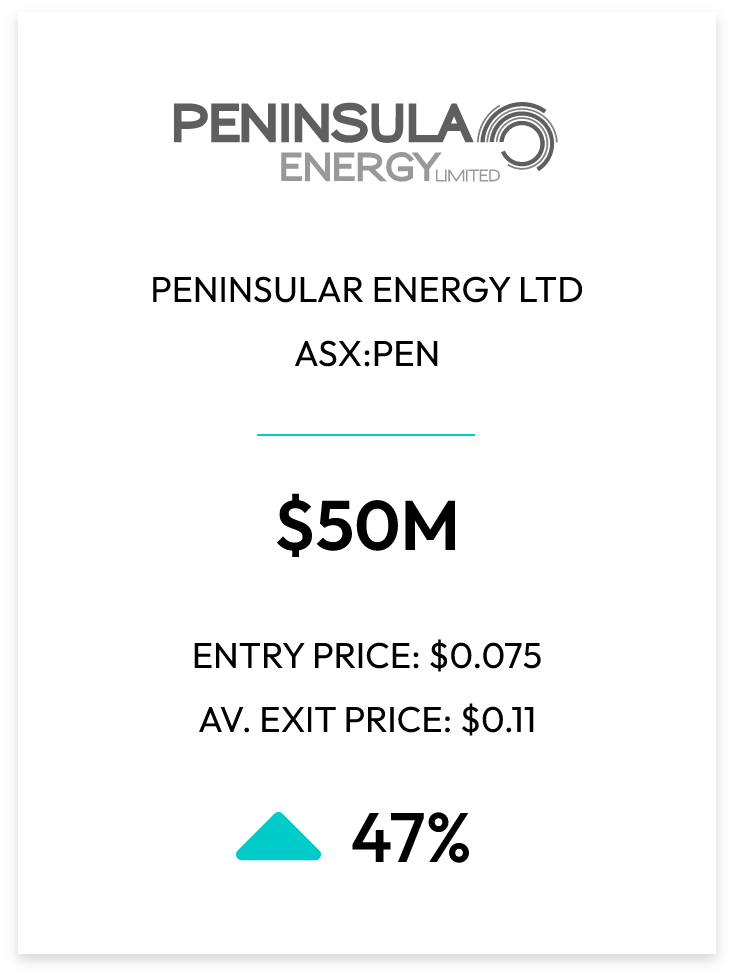

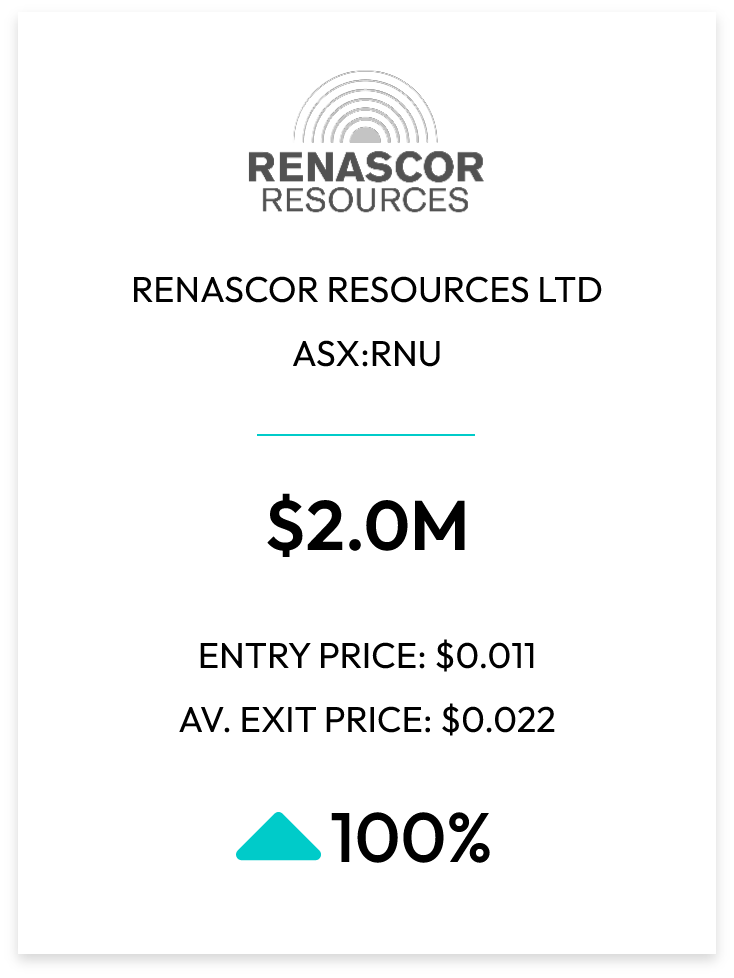

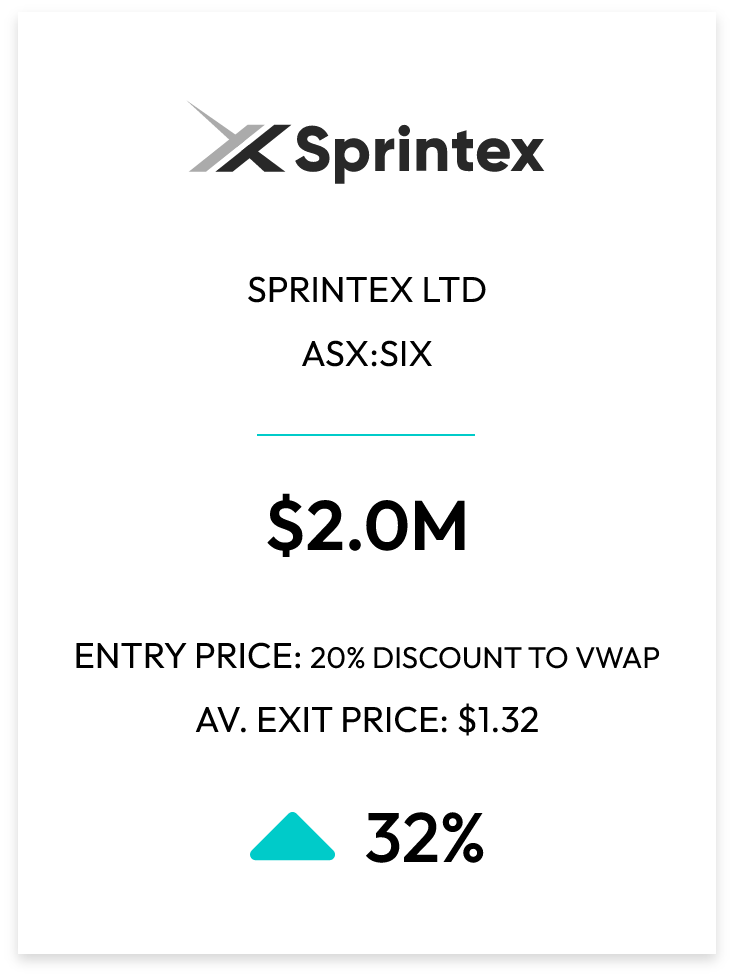

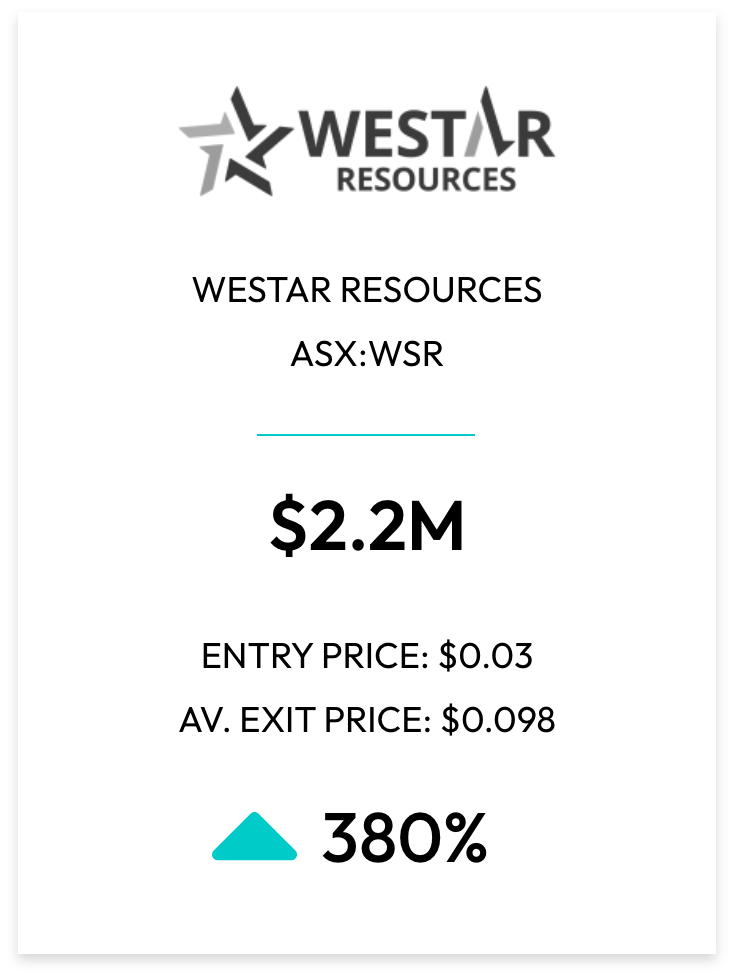

OUR TRACK RECORD

We are renowned within the industry among the most successful investors specialising in capital raising opportunities

POST TRADING SUPPORT

Our trading desk supports Investors every step of the way to maximise market returns and trade with ease.

Take advantage of our experience and huge network of brokers and ASX listed companies.

INDUSTRY CONNECTIONS

Take advantage of our experience and huge network of brokers and ASX listed companies.

With 50 years of experince in identifying attractive and exclusive deals to deliver strong return.

50+ YEARS EXPERIENCE

With 50 years of experince in identifying attractive and exclusive deals to deliver strong return.

Our Trading Desk supports Investors every ste of the way to maximise market returns.

POST TRADING SUPPORT

Our Trading Desk supports Investors every ste of the way to maximise market returns.

What We Look For

MEANINGFUL CATALYSTS

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna Lorem ipsum dolor sit amet, coLorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna Lorem ipsum dolor sit

SIGNIFICANT PRICE APPRECIATION

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna Lorem ipsum dolor sit amet, coLorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna Lorem ipsum dolor sit

SECTORS WITH HIGH MOMENTUM

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna Lorem ipsum dolor sit amet, coLorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna Lorem ipsum dolor sit

Significant share price appreciation potential

We look at the historical patterns and share price movement from past announcements on charts primed to breakout upon receiving positive news flow. Other factors of interest include market cap comparison to the opportunity, commodity price movement and a leadership team with a track record of execution success.

Meaningful catalysts

We look for shares with a pipeline of pending announcements that are expected to positively affect buyer demand and the share price. These can include government approvals, new sales contracts, drilling results and feasibility studies.

Sectors with lots of momentum

We’re looking for a sector with a massive tailwind undergoing structural change. This includes looking at broader themes such as mining, then honing on a particular sub-sector e.g. copper or gold.

Meaningful

catalysts

We look for shares with a pipeline of pending announcements that are expected to positively affect buyer demand and the share price. These can include government approvals, new sales contracts, drilling results and feasibility studies.

Significant share price appreciation potential

We look at the historical patterns and share price movement from past announcements on charts primed to breakout upon receiving positive news flow. Other factors of interest include market cap comparison to the opportunity, commodity price movement and a leadership team with a track record of execution success.

Sectors with lots of momentum

We’re looking for a sector with a massive tailwind undergoing structural change. This includes looking at broader themes such as mining, then honing on a particular sub-sector e.g. copper or gold.

Meaningful

catalysts

We look for shares with a pipeline of pending announcements that are expected to positively affect buyer demand and the share price. These can include government approvals, new sales contracts, drilling results and feasibility studies.

Significant share price appreciation potential

We look at the historical patterns and share price movement from past announcements on charts primed to breakout upon receiving positive news flow. Other factors of interest include market cap comparison to the opportunity, commodity price movement and a leadership team with a track record of execution success.

Sectors with lots of momentum

We’re looking for a sector with a massive tailwind undergoing structural change. This includes looking at broader themes such as mining, then honing on a particular sub-sector e.g. copper or gold.

What Makes Us Different

OUR ACCESS TO DEAL FOCUS

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna Lorem ipsum dolor sit amet, coLorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et

OUR HUGE BROKER NETWORK

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna Lorem ipsum dolor sit amet, coLorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et

OUR STRONG TRACK RECORD

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna Lorem ipsum dolor sit amet, coLorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et

OUR PLACEMENT SELECTION

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna Lorem ipsum dolor sit amet, coLorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et

/ Shaun Factor, CEO

The Latest From The Trade Desk

GREG LOWE CO-FOUNDER + DIRECTOR

20+ years experience as a professional hedge fund Investor, most notably as a partner at $3bn fund P.Schoenfeld Asset Management, Credit Suisse, and Schroders (New

SHAUN FACTOR CO-FOUNDER + DIRECTOR

20 years experience as a full-time Share Investor, Specialising in Micro & Small Cap ASX listed Companies. Spends countless hours studying term sheets to find

This is a News Article

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s,

Our Partners

Schedule a call to discuss investment opportunities

Invest alongside leaders of the ASX placement space in high conviction opportunities within the micro and small cap space.